ULTY Climbs into Mid-Range Zone

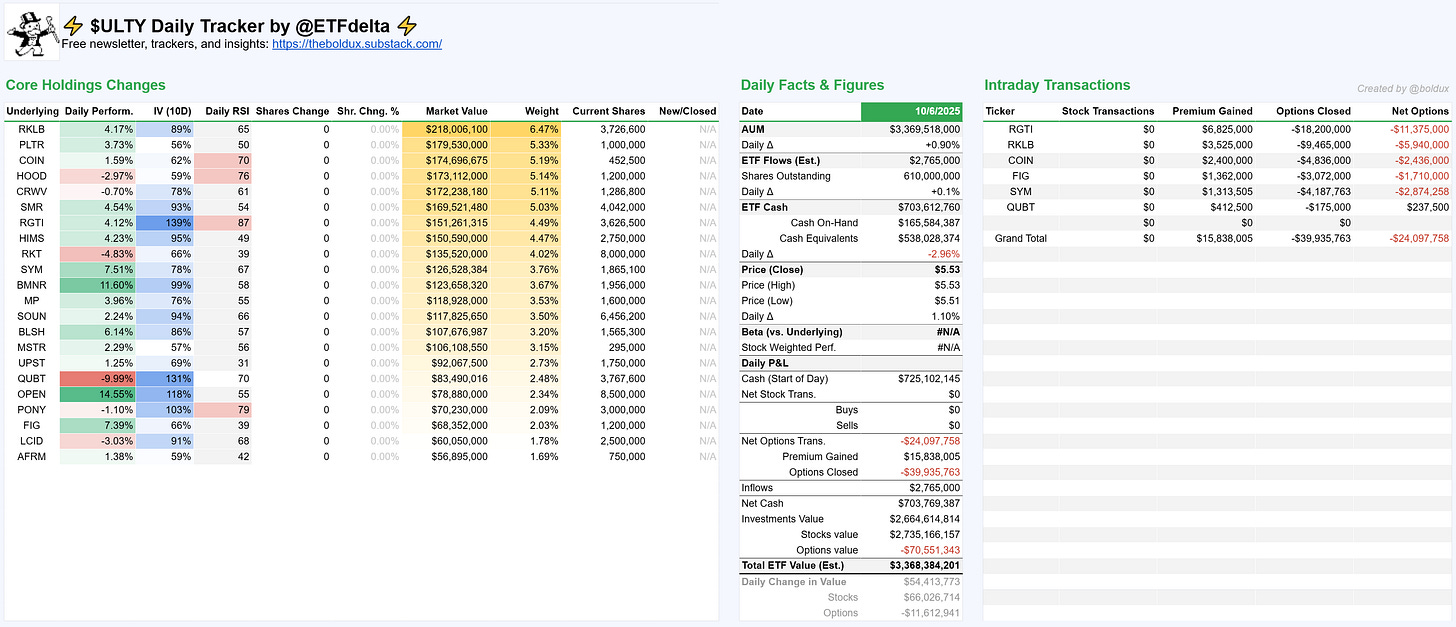

ULTY/SLTY Daily Tracker: 10/6/2025

We’re kicking off the week on a high (but quiet) note. With the broader market further enabling the performance of the underlying basket, ULTY 0.00%↑ continued its momentum all-day long alongside minimal underlying trading. In terms of NAV, we’re now back to the middle of the current price channel ($5.39 to $5.69) — and at all-time high total return too. This is important for two key reasons. The first being that more cushion is being created for this week’s ex-div drop. The second being that each day that goes by further validates the potential that NAV is stabilizing & range bound (as was did over the summer), which would likely increase interest from a variety of investor types.

Community Poll: What do you do with your weekly ULTY distributions?

Note: Stock cashtags are real time — therefore, they won’t always match with the text

⚡ ULTY Highlights:

AUM: $3.37B

New Inflows (est): $2.8M

Cash Balance: $703M

Options Credit/Debit: -$24M

Position changes:

New positions: N/A

Closed positions: N/A

Top Increased (shares): N/A

Top Trimmed (shares): N/A

Dashboard view:

On mobile? Pinch-zoom to view images at a larger size.

View the full Google Sheets tracker: ULTY 🔗

Enjoy the content? Consider upgrading to a paid subscription to support ETF Delta.

Support from readers keeps the insights flowing, plus you get access to VIP Insights.

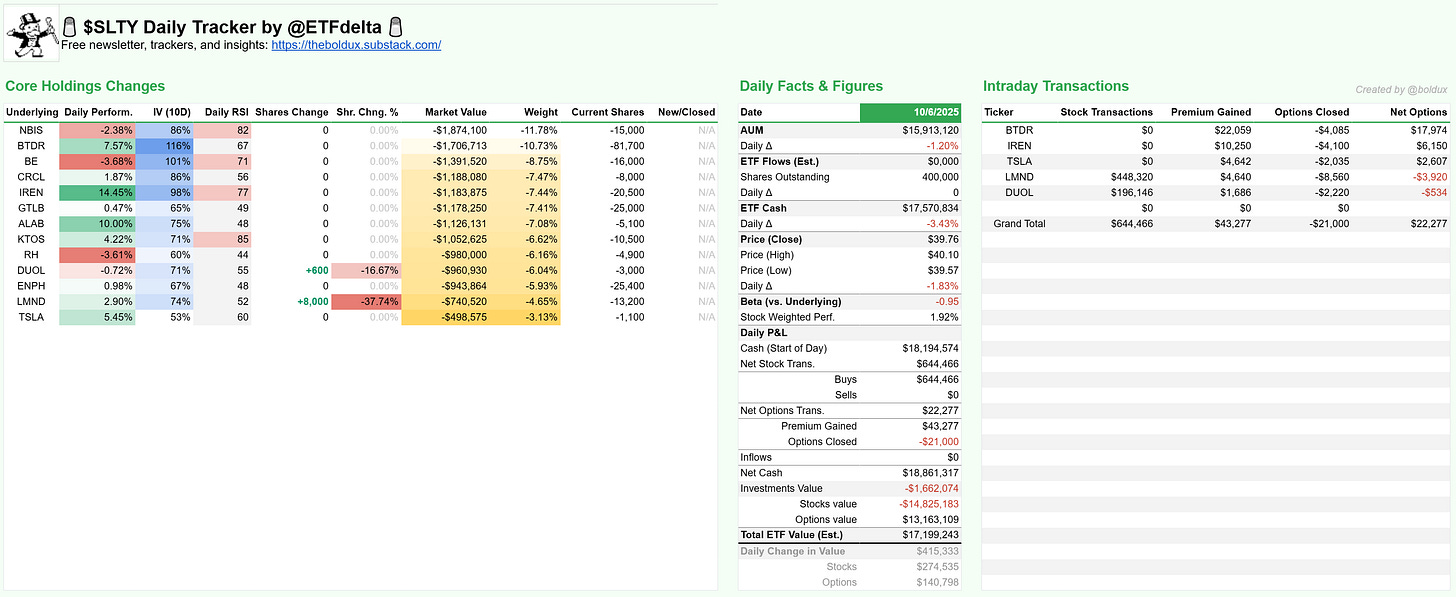

🧂 SLTY Highlights:

AUM: $15.9M

New Inflows (est): $0M

Options Credit/Debit: $22.2k

Position changes:

New positions: N/A

Closed positions: N/A

Top Increased (shares): N/A

Top Trimmed (shares):

LMND 0.00%↑ (-37.7%)

DUOL 0.00%↑ (-16.7%)

Dashboard view:

On mobile? Pinch-zoom to view images at a larger size.

View the full Google Sheets tracker: SLTY 🔗