6 Rival ETFs Aiming to Dethrone ULTY

New high yield ETFs from Roundhill, REX Shares, and others will soon launch to become direct ULTY competitors

Up until now, there’s been no true direct competitors for ULTY 0.00%↑, but that will likely soon be changing. There are six high-yield ETFs slated to launch starting in October that aim to follow the same modus operandi: high yield and maximum income derived by an actively managed a basket of underlying stocks.

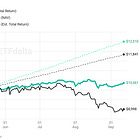

In many ways, ULTY was a trailblazer by providing a “mini-hedge fund” ETF for retail investors. Although it has had various growing pains, once “ULTY 2.0” fully rolled out and rode the 2025 bull market momentum, it went viral. AUM increased 10x in matter of months, scaling from $300M to over $3 billion.

Clearly there’s investor appetite of this type of unique ETF (compared to single-stock income funds) and it’s no wonder that other top ETF issuers are now seeking a piece of the pie.

The Competitor Shortlist

At the end of the day, competition is healthy. It gives investors choice and it puts pressure on each ETF issuer to remain competitive, innovative, and striving for the best performance possible. We’ll be breaking down the details of each of these six ETFs:

REX IncomeMax Option Strategy ETF

Kurv High Income ETF

Roundhill Meme Stock Covered Call ETF

Fundstrat Granny Shots US Large Cap & Income ETF

NEOS Long/Short Equity Income ETF

Tidal Smart Allocation High Income ETF

Filing Breakdowns Per Competitor

After reading the filed prospectus for each, I’ve ranked these six ETFs in order of direct similarity to ULTY. Many share the same objective, but some vary in their approach and mechanics which opens the door for them to potentially outperform (or underperform) across the core ”trifecta” metrics: yield, NAV stability, and total return.

Note: The filing and prospectus per fund may not be complete and could change before the ETF is launched. It’s also not a guarantee that the ETFs will launch on the exact effective date.

REX IncomeMax Option Strategy ETF

Summary: This upcoming ETF from REX Shares appears most similar to ULTY. The ETF will target high IV stocks to maximize option premium and income generation. While there’s no full list of options strategies available, we can get a sense they will leverage more than just covered calls in order to help mitigate downside losses while also being able to capture extra upside appreciation.

Filing date: August 8, 2025

Effective date (est. launch): October 22, 2025

Distributions: Weekly

Objective:

Primarily to seek current income. The Fund’s secondary investment objective is to seek exposure to the share price of select U.S.-listed securities, subject to a limit on potential investment gains.

Equity Strategy:

Primarily invests directly in underlying stocks with high IV while also considering timing of material events (aka. earnings). The basket of stocks will span various sectors and industries (and small to large cap companies).

Option Income Strategy:

Writing calls or puts to generate income. Further details of all available options strategies are not defined.

If any underlying stock doesn’t have enough options liquidity, they may purchase options on an ETF that serves as an alternative for that underlying stock.

Downside Protection:

Ability to adjust options strategy on a per stock basis to help mitigate potential downside losses.

Upside Gain:

Ability to adjust options strategy on a per stock basis to help capture potential upside appreciation.

Filing: LINK

Kurv High Income ETF

Summary: This Kurv ETF may be the first out of the six to launch in the weeks ahead. Their options income strategy includes a full suite like ULTY, but they also have the ability to buy calls which can help capture more price appreciation from the underlying stocks. Beyond just high IV, they will build an underlying basket of stocks (and options/derivatives) based on growth, momentum, and other characteristics.

Filing date: July 25, 2025

Effective data (est. launch): October 8, 2025

Distributions: Monthly (Weekly)

Objective:

Primarily seeks to provide current income. The Fund’s secondary objective is to seek to provide capital appreciation.

Equity Strategy:

Underlying basket based on favorable outlooks, examining characteristics of a particular issuer, such as growth or momentum, as well as the implied volatility of the derivative instruments of Listed Securities.

Will gain underlying exposure through stocks, ETFs, or options/derivatives.

Option Income Strategy:

Writing covered calls, uncovered calls/puts, call/put spreads, and collars to generate net premium income.

On a monthly basis or more frequently, the Fund will sell call option contracts on the underlying Listed Security with expiration dates of approximately one month to 12-months at strike prices that are approximately equal to 5%-15% above the then-current share price of the underlying Listed Security.

Downside Protection:

Out-of-the-money protective puts and collars to limit losses from underlying share price decline

Upside Gain:

Out of the money calls to gain extra price appreciation from underlying share price increase

Filing: LINK

If you’re enjoying this competitor analysis, consider upgrading to a paid subscription to support ETF Delta (starting at a discounted $6/mo USD).

Support from readers keeps the insights flowing, plus you get access to VIP Insights.

Roundhill Meme Stock Covered Call ETF

Summary: This upcoming Roundhill income ETF focuses fully on “meme stocks” (which tend to exhibit high volatility and momentum characteristics). Implied in the name and other info available, this appears to be a much more straight forward and traditional covered call ETF. This means there is limited or no downside protection, however that often means greater (but capped) price appreciation compared to ULTY.

Filing date: August 22, 2025

Effective data (est. launch): November 5, 2025

Distributions: Weekly

Objective:

Primarily to provide current income. The Fund’s secondary investment objective is to provide exposure to the return of the Roundhill Meme Stock ETF (which has not yet been launched either).

Equity Strategy:

Invests in the reference ETF (Roundhill Meme Stock), which holds a portfolio of “meme stocks” characterized by their exceptional liquidity and extreme price volatility driven more by social media momentum than by fundamental analysis.

Rebalancing may occur as frequently as weekly across a minimum of 13 and maximum of 25 securities within the portfolio.

Option Income Strategy:

Selling out-of-the-money call options on the reference ETF

It is expected that the Meme Stock ETF Call Options the Fund will sell to generate options premiums will generally have expirations of approximately one week or less and will be held to or close to expiration.

Downside Protection:

N/A

Upside Gain:

N/A (limited/capped due to traditional covered call strategy)

Filing: LINK

Fundstrat Granny Shots US Large Cap & Income ETF

Summary: Fundstrat’s upcoming income ETF piggyback’s off of the success of their similar named growth ETF (GRNY). The underlying basket focuses on large cap momentum/growth/disruptive innovation stocks. Since this is backed by Tidal, it comes with the same suite of options income strategies as ULTY, including collars which provide some downside protection.

Filing date: August 20, 2025

Effective data (est. launch): November 3, 2025

Distributions: Monthly (could change before launch)

Objective:

Primarily seeks to provide current income, with a secondary objective of long-term capital appreciation.

Equity Strategy:

A portfolio of large cap, equally weighted stocks that match certain theme buckets that have the potential to fundamentally impact the U.S. economy and stock market — likely to match the holdings of GRNY 0.00%↑ (the Granny Shots US Large Cap ETF focused on growth).

Includes a top-down fundamental analyses, including qualitative assessments of thematic relevance and correlation analysis, followed by a quantitative screening process, including: momentum, sentiment, free cash flow, valuation…etc.

Option Income Strategy:

For all or some of the holdings: selling covered calls, credit spreads, diagonal call spreads, cash-secured puts, calendar call spreads, collars, and debit spreads.

Downside Protection:

Protective puts as part of the collar strategy

Upside Gain:

Limited, but there is some indirect (and capped) additional upside if debit call spreads are leveraged.

Filing: LINK

NEOS Long/Short Equity Income ETF

Summary: It appears NEOS is aiming to combine parts of ULTY and SLTY in this upcoming ETF. The fund will actively manage a split portfolio of long and short exposure to a variety of stocks, which could help provide greater NAV stability. Additionally, beyond yield generated from the underlying, they’ll primarily generate income in a tax efficient manner by leveraging put spreads on the S&P 500 (SPX Index).

Filing date: Sept 19, 2025

Effective data (est. launch): December 3, 2025

Distributions: Monthly

Objective:

Primarily seeks to generate high monthly income in a tax efficient manner with the potential for equity appreciation.

Equity Strategy:

Hold long and short positions in mid and large cap U.S. exchange-traded equity securities

The long portfolio will be comprised of equity positions in approximately 25-35 listed companies, each ranging from 3% to 7% weight. Holdings are selected based on expected returns and factors including quality of management of the issuer, earnings and cash flow, shareholder yield, balance sheet strength…etc

The short portfolio of the Fund will be comprised of positions in approximately 25-35 listed companies, each ranging from of 1.5% to 3% weight. Holdings are selected based factors like poor cash flow, weak balance sheets, adverse conditions impacting a sector…etc.

Generally, after the Fund sells a portfolio security, it will not purchase the same security for the Fund for at least 30 days. Rebalancing can occur weekly or on longer durations based on internal signals.

Option Income Strategy:

In addition to any yield from the long/short strategy, the ETF will sell options on the S&P 500 (SPX) — which are tax-friendly (gains are automatically split 60% long-term, 40% short-term).

Includes selling a put, as part of a put spread strategy, to generate income.

Downside Protection:

Limited to the performance of the long/short basket of underlying stocks

Note: The put spread includes buying a put a lower strike price which provides some downside protection specifically for the option position itself.

Upside Gain:

N/A (based on performance & weighting of the long/short underlying basket)

Filing: LINK

Research Spotlight: The truth behind ULTY NAV decline and a proposed smart approach to balance yield and capital for smoother performance.

Tidal Smart Allocation High Income ETF

Summary: This ETF is the biggest outlier in the list and operates as a “fund of funds” based on Tidal-family (ie. YieldMax/Defiance…etc) ETFs. It takes a risk-conscious approach to the underlying by diversifying across fixed income, stocks, commodities and other assets. Although the target yield is pegged to 20-30% (high, but much lower than ULTY), that comes with potential reduced volatility and NAV stability.

Filing date: June 6, 2025

Effective data (est. launch): October 17, 2025

Distributions: Monthly

Objective:

Primarily to seek current income while managing risk.

Equity Strategy:

A “fund of funds” primarily invested in affiliated (Tidal) ETFs, but may invest in unaffiliated ETFs. Includes 5 to 25 ETFs that may be actively or passively managed and/or have long or short exposure. Excludes other fund of funds ETFs.

Asset class diversification spans fixed income (20-50% weight), equities (5-20% weight), commodities (0-20% weight), digital assets (0-10% weight), and other assets (including real estate; 0-20% weight).

Underlying basket will be periodically rebalanced based on income generation and risk management objectives.

Option Income Strategy:

Targeting an annual distribution rate of 20-30%

Income will be derived from fixed income underlying assets and the fund may invest in underlying ETFs, across asset classes, that employ option overlay strategies such as covered call writing that seek to generate income.

Downside Protection:

The risk-based approach considers how much each asset class contributes to the Fund’s total portfolio risk. This methodology is intended to promote a more balanced risk profile by limiting the extent to which any single asset class drives overall portfolio volatility.

Underlying ETFs may include those with short exposure or other hedges

Upside Gain:

N/A

Filing: LINK

Only time will tell if any of these ETFs can dethrone ULTY and outperform the “OG” ultra income ETF. While beating 85-88% annualized yield is a tall feat, that’s only half the battle. NAV stability and total returns are equally important performance metrics for many investors and whichever ETF can strike the best balance is likely to become the category leader.

As a fan of portfolio-based ETFs (vs single-stock ETFs), I’m quite excited for the weeks ahead — and if the market rallies into the end of the year it’s the perfect environment for these funds to debut and thrive. We’ll be tracking them as they go live, so stay tuned for more news and analysis.

Which of these six ETFs are the excited for most? Drop a comment below!

Imitation is the best form of flattery. Will be watching but won’t be jumping from the ULTY boat just yet.

NEOS and Fundstrat might get my funds.