Two ULTY Alternatives for NAV Stability and Total Returns

These two alt ETFs shine on their own — but when blended with ULTY, they could create a thematic "holy grail" of yield, NAV stability, and total return.

Rule #1 to investing in options income ETFs is that you need to be bullish on the underlying holdings. That’s a must given most of these funds leverage bullish strategies to harvest premium while also benefiting from (capped) upside price appreciation.

Rule #2 is defining your expectations regarding yield rate, NAV, and total return trends in order to hit your overall investment goals and remain within your risk tolerance. This is often best achieved with a blended portfolio approach rather than only investing in one fund and hoping it performs across all three metrics (which is often not the case).

And lastly, what if I told you that ULTY 0.00%↑ isn’t your only option if you’re bullish on an actively managed basket of disruptive and innovative companies — many of which also share high IV and explosive growth potential?

In this article, we’ll dig into two alternative income ETFs and one growth ETF that not only show high correlation to ULTY, but also deliver NAV growth (instead of erosion) and strong total returns.

Overview of Funds

Prospectus & Strategy Comparison

Holdings & Correlation Comparison

Performance: Price returns (NAV), Total returns, and Trade-Offs

Weighted Model Portfolios for Balanced Performance

This article is for informational and educational purposes only. It is not financial, investment, tax, or legal advice.

This is Part 2 of a two part-article about achieving balanced performance across NAV stability, yield, and total returns. Click here to read Part 1: How to Fix NAV Erosion with ULTY

Overview of Funds

The two alternative income ETFs I’ll be covering today are OARK 0.00%↑ and EGGY 0.00%↑ — both of which are part of the Tidal/YieldMax family.

Why OARK?

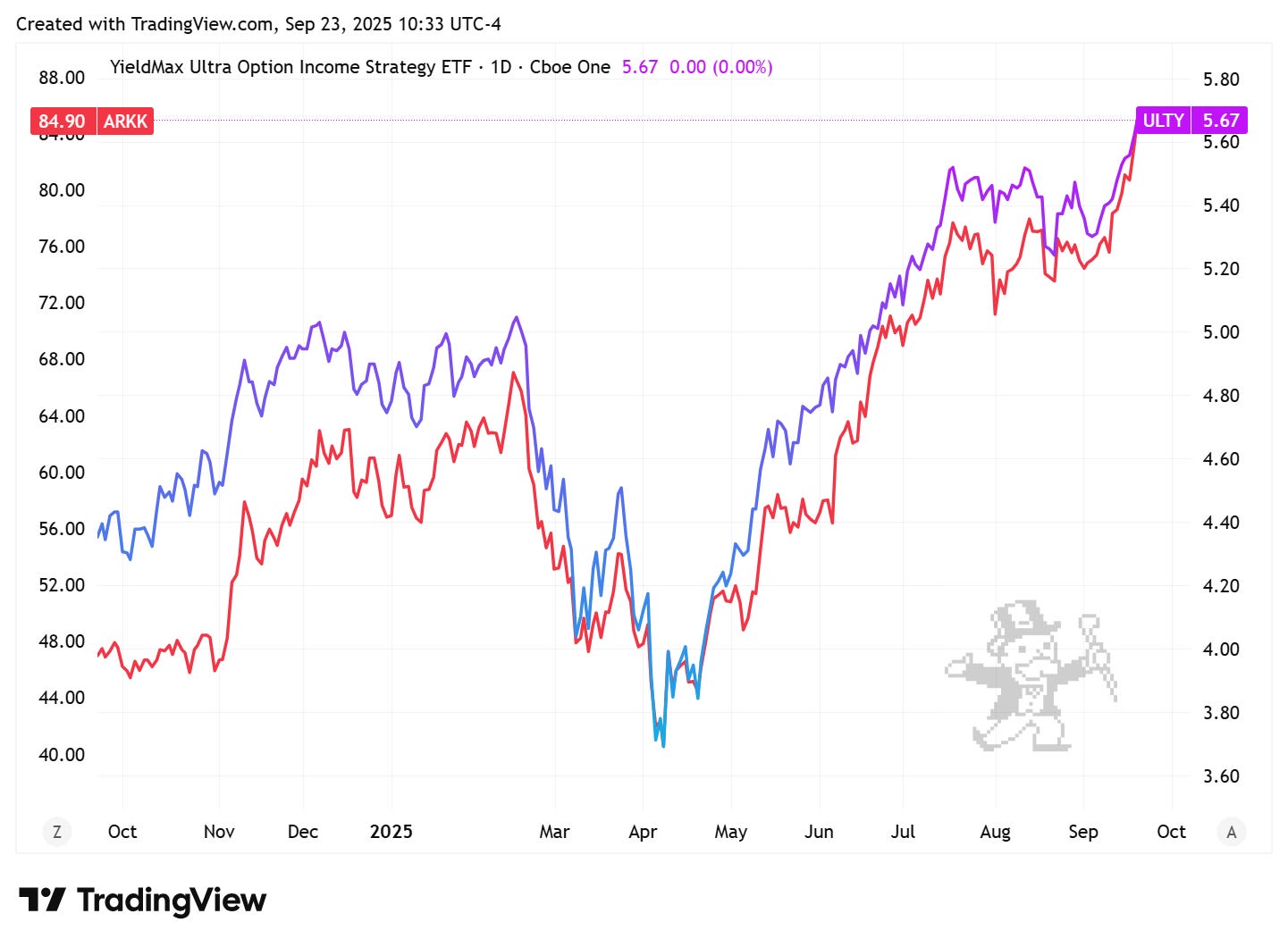

My original correlation analysis, back in early August, showed that QQQ 0.00%↑ was losing correlation and there were better references for ULTY. ARKK 0.00%↑ was one of those stronger contenders, which makes sense given the ETF’s overall innovation theme — just check out the 1-year price chart below (adjusted for total returns):

ULTY and ARKK exhibit nearly identical price action trends, including the mid-July to September sideways action (while the broader markets continued their uptrend). Therefore, it’s a no-brainer that OARK is an correlated alternative to ULTY — especially since its the only income ETF out there directly pegged to ARKK.

Why EGGY?

Correlation is also high between EGGY and ULTY, thus similar performance trends. And while the mechanics and prospectus aren’t a true 1:1 match, EGGY also deploys some downside protection and a quantitative approach to stock picking which ends up with a strong amount of overlap for the underlying stocks. Full correlation data and holdings comparison further below.

It’s wild that discussions about these two ETFs are sparse and often get overshadowed by more popular funds, especially considering OARK has been around since 2022. Shoutout to Income Architect who recently published a video on EGGY.

While a lot of this correlation data holds true historically, all 3 of these funds are actively managed and are prone to evolve over time — especially OARK since ARKK isn’t within the Tidal/YieldMax family. They’re also each in various stages of their lifecycles so changes to mechanics or other “features” could also cause performance differences moving forward.

As we dig deeper into performance comparisons in the sections below, just remember how each of these three ETFs could serve different purposes when you think about overall portfolio performance. What do you care about most between NAV preservation, total returns, and yield — and at what cost are you willing to achieve balanced performance?

Research Spotlight: The truth behind ULTY NAV decline and how to offset it

Prospectus & Strategy Comparison

All 3 ETFs are options-based income funds, but there are a few nuances to call out for each which impact how they operate and what type of performance they can achieve:

ULTY

Objective

Primarily to seek current income. The Fund’s secondary investment objective is to seek exposure to the share price of select U.S. listed securities, subject to a limit on potential investment gains.

Equity Strategy

Targeting stocks with high levels of implied volatility

Considers significant upcoming events like company earnings

Largely unconstrained when it comes to market cap or industry/sectors

Option Income Strategy

Wide variety of options available including covered calls, put selling, and credit/diagonal/calendar or debit spreads.

Most commonly deploy a collar strategy and sometimes leverages short put spreads.

Downside Protection

Protective puts on underlying holdings, as part of the collar strategy, provide some cushion to downside movements.

Upside Gain

Less than traditional covered-call ETFs given the overall “collar strategy”

Distributions: Weekly

Expense Ratio: 1.3% (temporarily discounted from 1.4%)

Prospectus: LINK

OARK

Objective

Primarily to seek current income. The Fund’s secondary investment objective is to seek exposure to the share price of the ARK Innovation ETF (ARKK), subject to a limit on potential investment gains.

Equity Strategy (derived from ARKK prospectus)

Focused on overall theme of “disruptive innovation” across genomics, energy, AI, next-gen tech, and fintech…etc

Selects high conviction stocks based on top-down (TAM analysis) and bottom-up (company research) framework.

Option Income Strategy

Covered calls on synthetic long exposure to ARKK

Downside Protection

N/A

Upside Gain

Standard covered-call ETFs upside (not 1:1 with underlying).

Includes occasional credit call spreads to increase exposure to upside moves in the underlying.

Distributions: Monthly

Expense Ratio: 0.99%

Prospectus: LINK

EGGY

Objective:

Primarily to seek current income. The Fund’s secondary investment objective is to seek exposure to the share price of select U.S. listed securities, subject to a dampening of potential investment gains, while also seeking to hedge against significant market downturns.

Equity Strategy

Large cap focus with quantitative and qualitative analysis

Financial metrics: market cap, market share, revenue growth, EPS, P/E ratio, profit margins…etc.

Further refined based on business model, competitive advantage, brand strength, and management team.

Option Income Strategy:

Covered calls on all or a portion of the underlying stocks

Downside Protection

Deploys long put options on equity indexes (S&P 500 or Nasdaq-100) or underlying stocks to protect against market downturns.

Upside Gain:

More than traditional covered-call ETFs (not 1:1 with underlying).

Includes deploying additional long OTM calls to increase exposure to upside moves in the underlying stock

Distributions: Monthly

Expense Ratio: 0.95%

Prospectus: LINK

In summary, ULTY is the most expensive in terms of fees but also provides the most “complex” mechanics in terms of generating max income and downside protection. EGGY and OARK follow more traditional covered call approaches to generate income, but EGGY includes some downside protection. There’s no right or wrong approach to the designs of these ETFs, but each “feature” does influence performance metrics (which we’ll cover further below).

It’s also worth noting that no true direct competitor to ULTY exists yet… but that will likely change before the end of the year. Click here to read more about 6 ETFs that are true ULTY competitors:

Holdings & Correlation

As mentioned above, all three of these ETFs have high correlation to each other through the lens of total return trends. This is largely derived from the fact that there is decent overlap in underlying holdings. Plus, keep in mind we’re talking about general sector/theme overlap too, so even if they aren’t holding 100% of the same stocks, price movement can trend similarly.

Note: Since OARK uses synthetic exposure to ARKK, we’ll be comparing the underlying stocks in ARKK. Tickers with an asterisk (*) indicate exposure via options instead of underlying stock.

The table above showcases the current holdings as of 9/19 for each ETF across four pages (use pagination to navigate). When looking at current overlap, and recent prior overlap, we can observe:

EGGY currently has 20% of its holdings overlapping with ULTY — rising to 47% if you include prior ULTY holdings that were recently sold.

OARK currently has 28% of its holdings overlapping with ULTY — rising to 41% if you include prior ULTY holdings that were recently sold.

Correlation coefficient analysis (based on total return) better showcases the ebbs and flows between the three funds since May — alongside ARKK as a reference. I chose this time frame since it was during ULTY’s “stable” period and after the switch to the new mechanics. It leverages a 14-day rolling average to account for the frequent active management of the funds.

The closer the correlation coefficient is to a 1, the stronger the correlation to ULTY:

OARK has an average coefficient of 0.72, with the latest value at 0.92

EGGY has an average coefficient of 0.78, with the latest value at 0.9

ARKK has an average coefficient of 0.84, with the latest value at 0.97

If you’re enjoying this deep-dive analysis, consider upgrading to a paid subscription to support ETF Delta (starting at a discounted $6/mo USD).

Support from readers keeps the insights flowing, plus you get access to VIP Insights.

Price returns (NAV)

When only looking at NAV performance (aka. price returns and capital preservation) we can start to see stark differences between ULTY versus OARK and EGGY.

For example, if an investor had invested $10,000 in each of the three funds on April 1st, their initial capital (without DRIP) would now be worth:

ULTY: $9,235 (a -8% decline in NAV/capital)

OARK: $11,857 (a +19% increase in NAV/capital)

EGGY: $12,398 (a +24% increase in NAV/capital)

If you want to learn more about the truth behind ULTY’s NAV erosion and the common risks of high yield ETFs, click here.

Total returns

When looking through the total returns lens (including DRIP), there is a much tighter uptrend between all three funds, with OARK standing out compared to ULTY and EGGY.

For example, if an investor had invested $10,000 in each of the three funds on April 1st, their total return (with DRIP) would now be worth:

ULTY: $13,763 (+38% growth in total return)

OARK: $15,152 (+52% growth in total return)

EGGY: $13,768 (+38% growth in total return)

This slight edge in performance likely due to the fact that OARK is actually paired directly to ARRK (which has seen +119% gains since the April lows). Although income ETFs all have capped upside, OARK doesn’t have any downside protection mechanics so there is often greater upside. Protection can often create extra performance drag given the costs of maintaining the hedge.

Performance Trade-Offs (Yield)

So far we’ve talked about price returns (NAV) and total returns, but now we have to talk about trade-offs — and that essentially comes down to yield and income.

It’s nearly impossible to have a “trifecta income ETF”: one that gives you stellar NAV growth, strong total returns, and ultra high yield. What typically happens is investors have to settle for one or two of the elements they value most.

Taking a look at the average distribution rate (aka. simple annual yield) since April, we can see big differences emerge:

ULTY: 84.8% distribution rate

OARK: 49.3% distribution rate

EGGY: 25.4% distribution rate

To put it another way, if an investor had invested $10,000 in each of the three funds on April 1st (without DRIP), they would have earned the following income:

ULTY: $3,908

OARK: $2,636 (33% lower income vs ULTY)

EGGY: $1,180 (70% lower income vs ULTY)

As mentioned earlier, ULTY is also the only weekly paying ETF of the three. However, that has it’s pros and cons. For those DRIPing, you can compound shares faster. On the flipside, especially in more calm market trends, weekly ex-div drops compound too and put extra pressure on the NAV (requiring the underlying basket to rise even more to offset).

It’s worth a reminder that investing isn’t an all-or-nothing game — and you don’t have to “full-port” into only one ETF. If you’re bullish on Tidal/Yieldmax and seek income from an actively managed basket of disruptive and innovative stocks, you now have four correlated assets in your arsenal to achieve greater balanced performance:

ULTY has high income, medium total return, and low (negative) price return

OARK has medium income, high total return, and medium price return

EGGY has low income, medium total return, and high price return

ARKK has no income, and high total return & price return

Ultimately, consider asking yourself these three questions to help strive towards a “trifecta income portfolio”:

How much do you value maximum income (at the cost of NAV erosion)?

How much do you value NAV growth/stability (at the cost of income)?

How much total return do you seek to achieve (regardless of NAV and income)?

While a bulk of the core insights and analysis are free in each article, I always like to include extra value for paid subscribers. Next, we’ll dive in below to showcase model portfolios featuring ULTY and/or OARK/EGGY/ARKK with optimal weightings for balanced performance and NAV stability. Let’s dig in.