Reverse Splits Announced. What does it mean?

High Yield Daily Tracker: 11/17/2025

If you hadn’t already heard, YieldMax filed to reverse split 12 of their ETFs late last Friday night. This ranges from 1:10 and 1:5 reverse splits and includes some popular ETFs like ULTY, CONY, TSLY and OARK.

What does it mean? Generally speaking, it’s simply a mathematical adjustment that will elevate the share price above $5 (which can help investors who use margin and trade options). Read this article for a full breakdown about reverse splits (and the pros/cons).

In the case for ULTY, it will be 1:10 reverse split that goes into effect Nov 28th. Therefore, the number of shares you own will be divided by 10 while the share price and weekly distribution will be multiplied by 10. Keep in mind that distributions rates change weekly, so it won’t be an exact multiple (but should be in the 50-60 cent range given the new diversified basket and an overall lower IV).

Research Spotlight: An easy-to-follow breakdown of ULTY performance over the past 7-months, lessons learned, and what comes next.

Note: Stock cashtags are real time — therefore, they won’t always match with the text

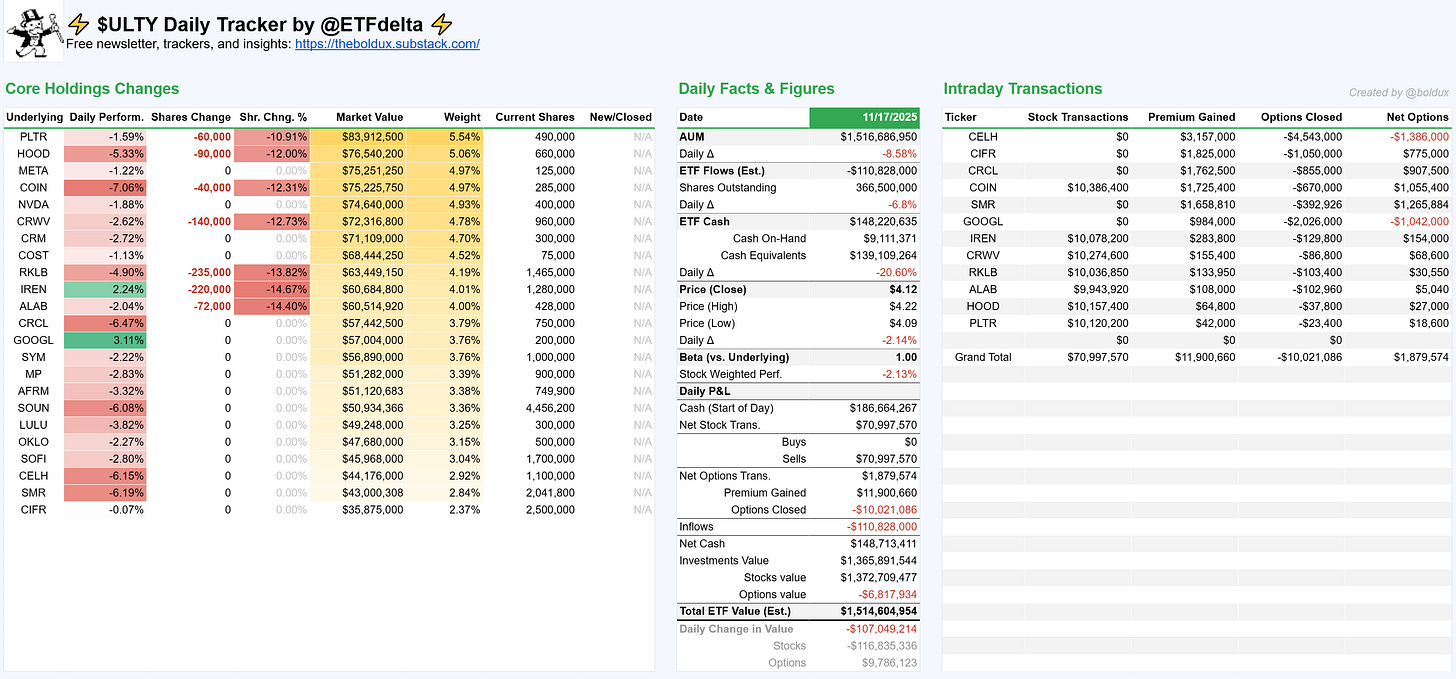

⚡ ULTY Highlights:

AUM: $1.52B

New Inflows (est): -$110.8M

Cash Balance: $148.2M

Options Credit/Debit: $1.9M

New positions: N/A

Closed positions: N/A

Top Increased/Trimmed (shares):

IREN (-15%)

ALAB (-14%)

RKLB (-14%

Dashboard view:

On mobile? Pinch-zoom to view images at a larger size.

View the full Google Sheets tracker: ULTY 🔗

Enjoy the content? Upgrade to a paid subscription to support ETF Delta.

Support from readers keeps the insights flowing, plus you get access to VIP Insights.

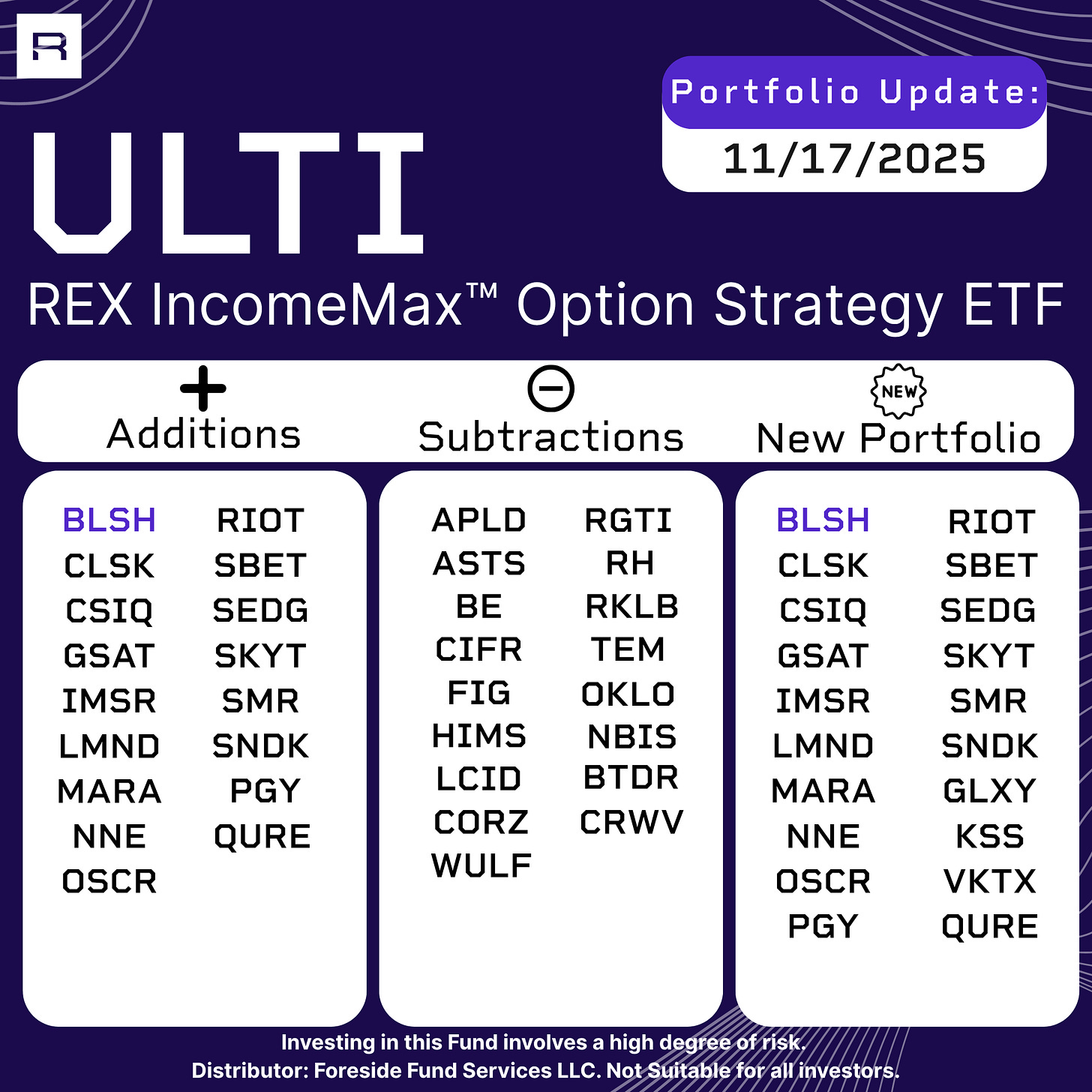

🔥 ULTI Highlights

AUM: $6.89M

Cash balance: $1.7M

Position Changes:

There remain to be technical difficulties with the daily holdings file on the website. Here’s a brief update from REX regarding adjustments

🤖 KYLD Highlights

AUM: $10.3M

Cash balance: $805k

Position Changes:

Closed positions:

RDDT

SHOP

SIL

TER

VST

Note: Keep in mind, due to data lags, these trades occurred on Friday of last week

💎 BLOX Highlights:

Trimmed position: HOOD (-30%)

🍳 EGGY/EGGS Highlights:

New Position: NFLX (for both EGGY and EGGS)→ this was a mix up due to the forward split (no change).No major updates to report. Holdings are proportionately scaled up/down pending daily fund flows.

🧂 SLTY Highlights:

No major updates to report. Holdings are proportionately scaled up/down pending daily fund flows.

Dashboard view:

On mobile? Pinch-zoom to view images at a larger size.

View the full Google Sheets tracker: SLTY 🔗

I think in the first paragraph, you meant to say 'above' rather than 'about $5'. Technically, reverse splits should be neutral, but rarely are they. Just as you can't be taxed into prosperity, I don't think reverse splits will help the total return of these funds. It will just help YieldMax from getting some of these de-listed so they can keep getting the management fees.

As you said, that $5 level allows people to use margin or options which helps keep more interest in the stock and allows some people to buy more so YM keeps their AUM higher, and collects more fees.

So unless YM makes fundamental changes, they'll just keep bleeding out over time like they've been doing to get to this point.