Long-Term Performance of High Yield ETFs

Analyzing 75+ ETFs over 3 years to set expectations about NAV, distributions, and total return performance.

If you ask me what I think is the biggest “problem” with high yield investing, I would say it is the misalignment between investor performance expectations and how these ETFs are actually built to perform.

Although some of the legacy high yield ETFs are over 3 years old, the influx of investors buying these products has risen significantly over the past year — if not, even just the past six months.

The driving force of this explosive growth is undoubtedly the eye catching weekly distribution rates (yields) that often eclipse 70% — sometimes even climbing to over 100%. As investor interest in passive income grows, these ETFs can appear as an easy source of “free money” that many investors are jumping into without fully understanding the underlying mechanics. If you pair that with a lack of risk management and a “set and forget” mindset (as if these were index funds or dividend aristocrats), it’s a recipe for disaster that allows for misaligned expectations to run rampant.

That said, there is a time and place for these products to deliver true value. In fact, with so many different high yield ETFs available it’s never been a better time for investors. The plethora of fund choices provides the freedom to craft an income portfolio based on target yield, underlying theme exposure, and various income strategies. Those that succeed in investing in high yield ETFs know what they are investing in and actively manage their investment strategy to hit their personal goals.

This article aims to illustrate long term trends and help level-set investor expectations. Just remember, not all funds are created equal and some are outliers that can buck the trend and outperform (or significantly underperform).

Let’s dig into an aggregate performance analysis of over 75+ high yield ETFs across key performance metrics:

NAV Performance

Distribution per Share Performance

Total Return Performance

List of Top Performing ETFs & Issuers

List of Worst Performing ETFs & Issuers

This article is for informational and educational purposes only. It is not financial, investment, tax, or legal advice.

Methodology

Here’s a quick overview of the logic and rules I applied to the data set to generate the aggregate performance charts below (based on median values).

Source: I used weeklypayers.com to generate the master list of nearly 150 high yield ETFs (monthly and weekly payers). Then, I layered on additional data sets, added custom formulas, and applied filtering.

Data Hygiene: Fund data is adjusted if a fund evolved from monthly to weekly payouts. I also compute distribution per share performance starting with the 2nd distribution after fund inception since the first is often volatile and not a true representation.

Exclusions: I excluded all short income ETFs and I also excluded any funds that had 12% or less distribution rate as I don’t classify those as “high yield”. All ETFs launched after Feb 19, 2025 are also excluded since there is not enough long-term performance across variable market conditions for accurate analysis.

Yield Tiers: I categorized the ETFs into 3 tiers based on average lifetime yield.

Tier 1 is 12-27% (26 funds)

Tier 2 is 28-47% (21 funds)

Tier 3 is 48%+ (30 funds)

This gives some wiggle room for generalizing results. For example, Tier 2 will be referred to as “30-50% yield”.

Timeframe: From launch date per fund to Nov 7, 2025.

The final list includes 77 high yield ETFs that range from 8 months to 4.5 years old, and span 12 different ETF issuers.

Research Spotlight: The truth behind ULTY NAV decline and how to offset it

NAV Performance

First, let me remind people income ETFs have investment objectives which are outlined in the fund’s prospectus. Obviously, “seeking income” is almost always the primary objective. The secondary objective is often “seeking exposure” to the underlying assets (aka. the “growth” aspect for price appreciation if underlying stocks go up).

The nuance here is that based on the innerworkings of each ETF, the amount of weight the 2nd objective holds in overall performance can be quite variable. For example, a traditional covered call ETF may only experience 70% upside potential. Other income ETFs could have higher or lower upside depending on their mechanics.

Based on the data, high yield ETFs that are over 2 years old with 50%+ yield have a median value of -62% for NAV decline. This shrinks significantly for lower tier yields with Tier 1 funds having a single-digit drawdown.

Expectation: NAV decline is a secondary effect of high yield income ETFs over the long term since investors are trading off NAV growth for current income.

The higher the yield, the greater the NAV decline (aka. trade off), so investors need to assess which yield tier may be most suitable for them based their personal goals and risk tolerance.

Fun fact: Of all the ETFs analyzed, over 80% of them had negative NAV performance during the reference period despite the longstanding bull market.

The list of ETFs with positive NAV performance is shared below.

Enjoy the content? Upgrade to a paid subscription with this limited-time discount:

Support from readers keeps the insights flowing, plus you get access to VIP Insights.

Distribution per Share Performance

Another worthy call out is distribution performance over the long term. Many investors believe that these funds will pay the same forever, which is not necessarily true depending on yield tier.

Most income ETFs operate with an approximate “target” distribution rate even if it’s not promoted as such. Income generated for the distribution is dependent on the implied volatility of the underlying assets, and the distribution and NAV both factor into the distribution rate formula. Therefore, even if the percentage rate remains stable, the actual payout value could increase or decrease alongside the NAV evolution. Of course, depending on the underlying IV, there can be temporary periods of higher rates and payouts.

Based on the data, high yield ETFs that are over 2 years old with 50%+ yield have a median value of -67% for distribution decline. For example, if the fund used to pay $1 per share, it now only pays 33 cents.

Although Tier 1 and Tier 2 ETFs that are over 2 years old have similar positive median values, keep in mind that this implies that performance ranges above and below this value. It does not represent that these tiers can’t experience distribution decline.

Expectation: In the short-term, distribution per share can rise and fall with IV spikes, but over the long-term it could trend down alongside NAV given “target” rates per fund.

This is often an overlooked factor when investors are forecasting income and planning their high yield portfolios. It’s easy to just take the latest numbers and assume the status quo, but it may be greatly misleading versus the potential reality 2-3 years later.

Fun fact: When looking at ETFs that are older than 1 year, 61% of them had declining distributions per share. The list of ETFs with positive distribution evolution is shared below.

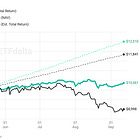

Total Return Performance

Total returns are often pegged as the north star performance metric for income funds — which makes sense given you need to combine income + NAV performance to truly understand your return on investment.

Total return is an output metric. Therefore, two ETFs could have the same total return but achieve it in different ways. For example, higher income + NAV decline or lower income + NAV growth. Neither “wrong” per say, as it’s always a trade off. Some investors want more income, others want more growth, or some want a balance.

Note: For the sake of trend analysis and the size of the data set, the total return calculation assumes no DRIP. Generally speaking, trends would be the same with DRIP, but just higher values.

It’s not surprising to see trends in the chart above and it’s worth calling out each tier increases in total returns over its lifetime. High yield ETFs with 50%+ yield deliver the lowest total return with a median value of 23% — nearly half the total returns of Tier 1 funds. Exceptions certainly exist as a couple of older legacy single-stock ETFs have 100%+ total returns during the reference period, but this data aims to normalize that.

Expectation: Significant NAV decay over 2+ years ultimately erodes total return potential. The more an ETF is weighted towards growth, the higher total returns it will likely achieve — especially due to the long-term uptrend of the broader market.

Fun fact: Looking at all ETFs in the data set, 10% had negative total returns since inception. The list of ETFs with negative total returns is shared below.

By analyzing the long term trends of NAV, income, and total returns, hopefully the trades off in expected performance between different tiers of high income funds becomes clearer.

The intention with this analysis was to show long-term performance trends (2+ years) based on data available today. However, we can see in some of the charts that shorter term trends tell a different story. I would caution that we need to see how this cohort of newer ETFs evolves as they mature through variable market conditions.

That said, it’s exciting to see how newer generations of high yield ETFs are quickly coming to market. It’s likely that their innovative underlying mechanics can improve performance over the long term. We will revisit this analysis in the future.

In the next section below we’ll dive into some bonus insights for paid supporters that specifically highlight performance of specific funds and top ETF issuers:

List of Top Performing ETFs & Issuers (NAV + Distribution Growth)

List of Worst Performing ETFs & Issuers (Negative Lifetime Total Return)

List of All 77 ETFs Analyzed (Data per ETF)

Limited-time offer: Get VIP access for 75% Off for 1 year 👇👇